What is HLM Takaful i-AcciPlus?

HLM Takaful i-AcciPlus is a 20-year takaful plan which provides protection against coma, non-accidental death, accidental death/TPD, road accidental death/TPD and accidental death during first Hajj. In the event of accidental death, 10% of the Accidental Death Benefit will be payable in advance as Funeral Benefit upon receiving just a burial certificate while the balance will be payable upon receiving the complete documentation. In the event of non-accidental death, we will pay the guaranteed cash surrender value (if any).

Upon survival of the Person Covered at the maturity of the certificate, 100% of the Total Contribution Paid will be payable at the end of the certificate term if no claim is paid.

What are the Shariah concepts applicable?

- Tabarru’ means donation from the portion of the contribution that will be allocated to the Participants' Risk Fund (PRF), which will be used for mutual aid and assistance among the fellow participants

- Iltizam Bi Al-Tabarru’ means the commitment to make Tabarru'.

- Wakalah means essentially an agent-principal relationship, where the Takaful Operator act as an agent on behalf of the participants to manage the PRF and PA and the Takaful Operator earns Wakalah Fee for services rendered.

- Ju’alah means an agreement in which the participant agrees to reward the Takaful Operator for its achievement or good performance in managing the PRF that leads to Surplus of the fund.

- Qardh means an interest-free loan provided by the Takaful Operator in the event of a deficit in the PRF.

What is the minimum and maximum entry age for HLM Takaful i-AcciPlus?

The minimum entry age is 30 days old while the maximum entry age is 60 years old, age next birthday (ANB).

How long is the coverage for HLM Takaful i-AcciPlus?

The coverage period for this product is 20 years.

What are the minimum and maximum coverage?

The Sum Covered for this product depends on the plan you participated.

|

Benefit

|

Plan 1 (RM) |

Plan 2 (RM) |

Plan 3 (RM) |

| Coma Benefit1 |

20,000 |

50,000 |

100,000 |

| Accidental Death/TPD |

100,000 |

250,000 |

500,000 |

| Accidental Death during first Hajj |

200,000 |

500,000 |

1,000,000 |

Road Accidental Death / TPD within Malaysia in private vehicle or public transport:

- During Non-Festive Seasons

- During Festive Seasons

|

200,000

400,000 |

500,000

1,000,000 |

1,000,000

2,000,000 |

What are the festive seasons covered under HLM Takaful i-AcciPlus?

The major festive seasons are the following festivities:

- First day and second day of Chinese New Year

- First day and second day of Hari Raya Aidilfitri

- Deepavali

- First day of Christmas

- First day of Hari Gawai

- First day of Harvest Festival

- Two days immediately before and after the aforementioned festivities

What will I receive in the event of coma?

Upon diagnosis of coma of during the certificate term, coma benefit sum covered shall be payable. In the event of coma due to accidental causes, and the Person Covered subsequently suffers death or total and permanent disability as a result of the same accident that gives rise to coma:

- within 2 years from the date of the accident that gives rise to coma or

- where the Person Covered recovers from the coma, within sixty (60) days from the date of recovery from the coma,

whichever is earlier, the Accidental Death Benefit, Accidental Total and Permanent Disability Benefit, Accidental Death during First Hajj, Road Accidental Death or Road Accidental Total and Permanent Disability Benefit whichever is applicable shall be payable, and shall deduct the coma benefit paid. During this extended coverage period, no contribution shall be required to be paid on this certificate.

If coma due to non-accidental causes is diagnosed during first 2 certificate years, Total Contribution Paid for the first 2 certificate years shall be payable.

What will I receive in the event of death due to non-accidental causes?

In the event of death due to non-accidental causes, we will pay a guaranteed cash surrender value (if any).

What will I get upon maturity of the certificate?

If no claim has been made prior to the maturity of the certificate, 100% of total contribution will be payable

Can I know more about the Value-Added Services?

In the event of accidental death or TPD, an amount will be deducted from the Takaful benefit payable under your certificate and paid to the service provider appointed by us. The details of services that you may choose are listed below:

| Service |

Amount (RM) |

Description |

| Hajj by Proxy |

3,500 |

Performing an obligatory Hajj (Pilgrimage to Mecca) on behalf of Muslim customers who are unable to perform Hajj by themselves due to sickness, old age or death. |

| Qurban |

750 |

Carrying out “Ibadah Qurban” on behalf of Muslim customers inclusive of purchasing and slaughtering livestock such as goat, sheep, cattle or camel. |

| Waqf |

500 |

A voluntary, permanent, irrevocable dedication of a portion of one’s wealth for religious or charitable purposes. |

Note: The amount shown above (except for Waqf) is subject to the prevailing market price in the year the service is carried out.

Can I change my coverage subsequent to the inception of the certificate?

No, change in coverage is not allowed.

What are the riders available to enhance my protection?

There is no rider attachable to this product.

What are the contribution payment mode and method?

You can pay your contributions on an annual, semi-annual, quarterly or monthly basis via cash, credit/debit card, auto debit, direct debit, standing instruction or Biro Perkhidmatan Angkasa (BPA).

How much contribution do I have to pay?

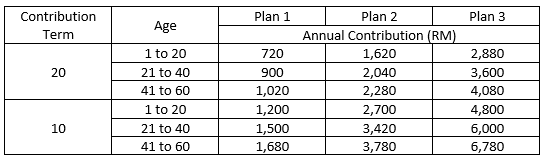

The contribution you have to pay is this depends on your age band, plan and contribution term selected.

Are the contributions paid for HLM Takaful i-Flexi Protect eligible for income tax relief?

Yes. You may qualify for a personal tax relief for the contributions paid under “Life Insurance/Takaful” up to RM3,000, subject to the final decision of the Inland Revenue Board of Malaysia.

What happens if I terminate my certificate early?

You may surrender your Takaful certificate by returning the Takaful certificate to us with a written notice signed by you. The cash surrender value from the PRF (if any) less surrender charge will be payable. You will lose the benefits under your Takaful certificate and the amount payable to you may be less than the total contributions that you have paid.

What are the exclusions for HLM Takaful i-AcciPlus?

- The Coma Benefit is not payable if the signs or symptoms of Coma is manifested within thirty (30) days from the Certificate Issue Date or any Reinstatement Date of this Certificate (whichever is the latest) or Pre-existing Illness or was caused directly or indirectly by the existence of Acquired Immune Deficiency Syndrome (AIDS) or by the presence of any Human Immuno-deficiency Virus (HIV) infection.

- If Coma is due to non-accidental causes during the first 2 certificate years, only the Total Contribution Paid shall be payable.

- The Accidental Death or TPD Benefits and Road Accidental Death or TPD Benefits is not payable for accidental death or TPD caused directly or indirectly by self-inflicted injury while sane or insane, declared or undeclared war, revolution, any warlike operations, riot and civil commotion, strikes or terrorist activities.

- The Road Accidental Death or TPD Benefits is not payable for accidental death caused of where the Person Covered rides a motorcycle or as a passenger on a motorcycle; or drives or rides on a Motor Vehicle with three (3) wheels and below or as a passenger on a Motor Vehicle with three (3) wheels and below; or is a pedestrian; or is a professional or commercial driver during the execution of his professional or commercial duties’ or the Road Accident that does not happen on the Road or happens outside of Malaysia.

- The Accidental Death during First Hajj Benefit is not payable for accidental death results while Person Covered performs ziarah or travel outside of Saudi Arabia during Hajj within the coverage period of forty-five (45) days for Hajj, or the actual travel duration, whichever is shorter.

Note: This list is non-exhaustive. Please refer to the Takaful Certificate and/or Supplementary Takaful Certificate for the full list of exclusions of the basic plan and selected Rider(s).